project ratings:

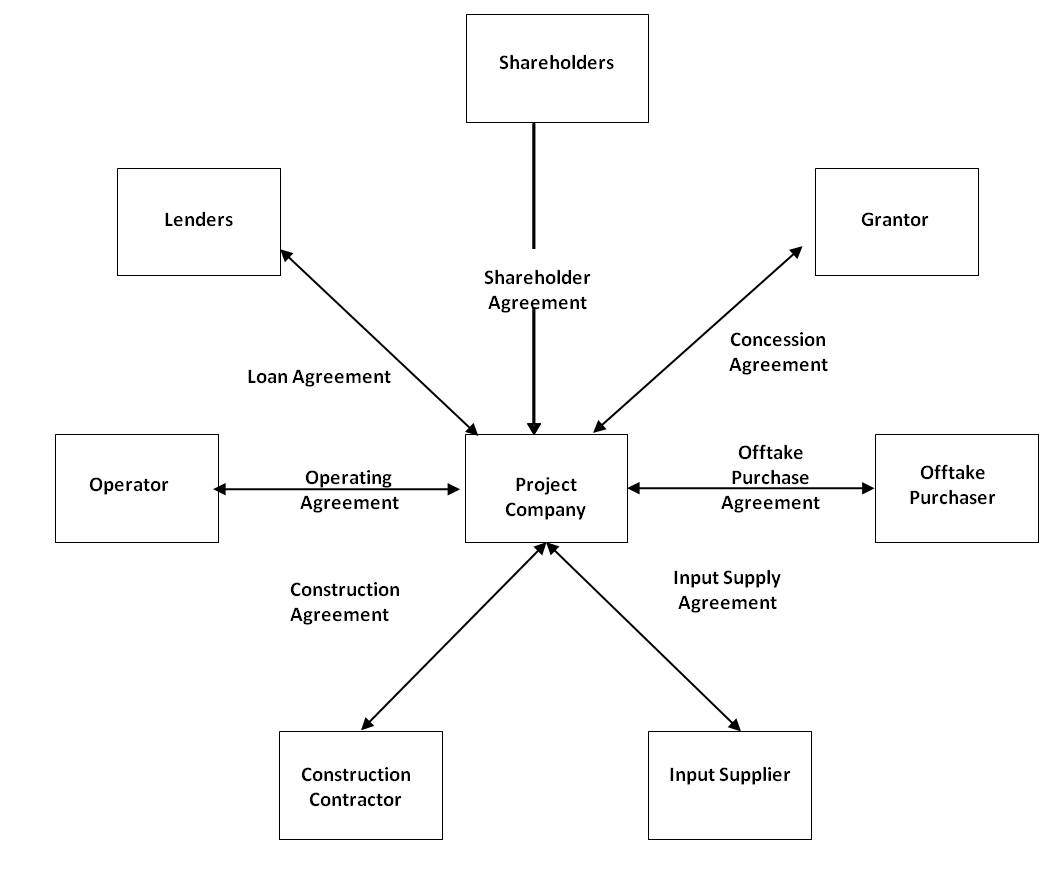

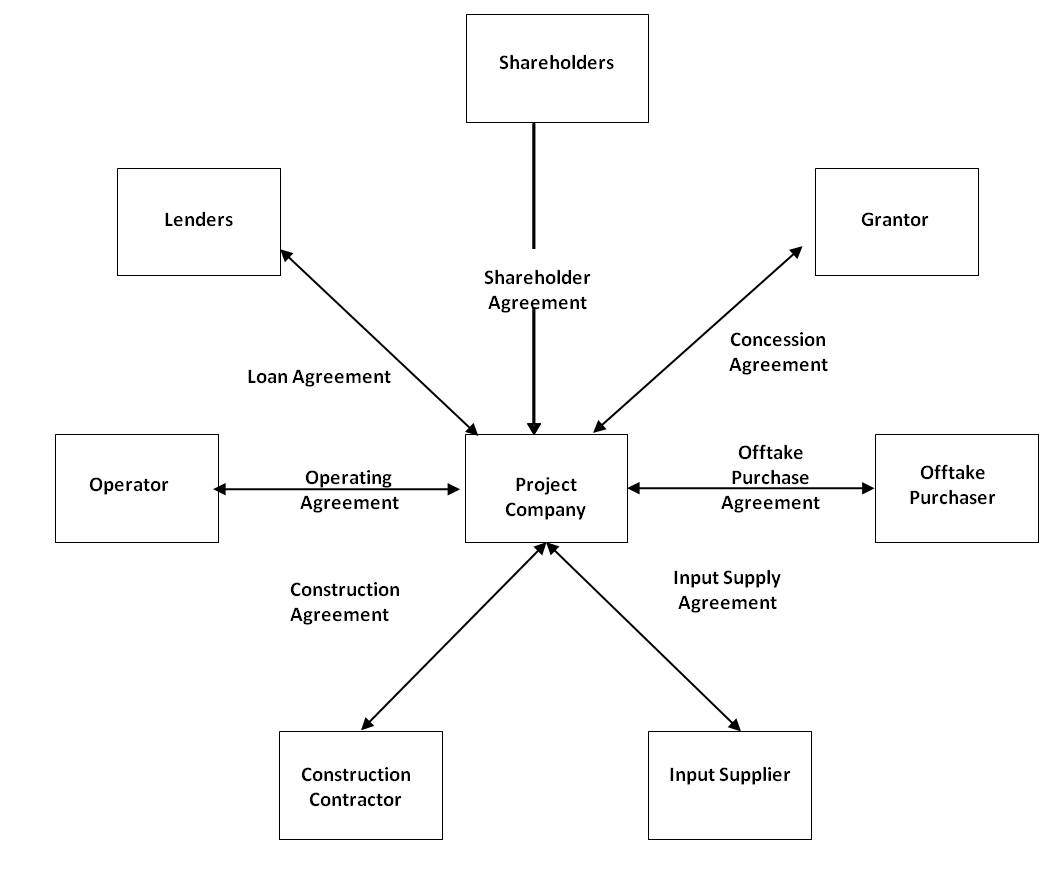

The typical project financing structure (simplified for these purposes) for a build, operate and transfer (BOT) project is shown below. The key elements of the structure are:

As can be seen, there are a number of contracts and the arrangements are complex. The interrelation between the different parties needs to be carefully provided in the agreements.

Typical Project Finance Structure

The typical project financing structure (simplified for these purposes) for a build, operate and transfer (BOT) project is shown below. The key elements of the structure are:

- Special purpose vehicle (SPV) project company with no previous business or record;

- Sole activity of project company is to carry out the project – it then subcontracts most aspects through construction contract and operations contract;

- For new build projects, there is no revenue stream during the construction phase and so debt service will only be possible once the project is on line during the operations phase (parties therefore take significant risks during the construction phase);

- Sole revenue stream likely to be under an off-take or power purchase agreement;

- There is limited or no recourse to the sponsors of the project (shareholders of project company are generally only liable up to the extent of their shareholdings);

- Project remains off-balance-sheet for the sponsors and for the host government.

As can be seen, there are a number of contracts and the arrangements are complex. The interrelation between the different parties needs to be carefully provided in the agreements.

No comments:

Post a Comment